The China Petroleum and Chemical Industry Federation (CPEC) and the China Chemical Industry Association (CCEA) have jointly released the “2021 List of Top 100 Petroleum and Chemical Companies in China”. The list is ranked according to the main business revenue of major petroleum and petrochemical companies in 2020 and the public data of listed companies, among which China National Petroleum Corporation(CNPC), China Petroleum & Chemical Corporation(SINOPEC), and Hengli Group are the top three on the list.

Top 100 Chinese Chemical Companies General Ranking

| Rank | Company Name |

| 1 | China National Petroleum Corporation(CNPC) |

| 2 | China Petroleum & Chemical Corporation(SINOPEC) |

| 3 | Hengli Group |

| 4 | Shandong Energy Group Co., Ltd. (SDE) |

| 5 | China National Offshore Oil Corporation(CNOOC) |

| 6 | China National Energy Investment Group(CHN ENERGY) |

| 7 | Sinochem Corporation(SINOCHEM) |

| 8 | Datong Coal Mining Group |

| 9 | China National Chemical Corporation(ChemChina) |

| 10 | Shaanxi Yanchang Petroleum |

| 11 | Shaanxi Coal and Chemical Industry |

| 12 | Zhejiang Rongsheng Holding Group Co., Ltd |

| 13 | Zhejiang Hengyi Group |

| 14 | Shenghong Holding Group Co., Ltd |

| 15 | Cedar Holdings Group Co., Ltd |

| 16 | Shanxi Coking Coal Group |

| 17 | Xinjiang Guanghui Industry Investment Group Co., Ltd |

| 18 | China Coal Energy |

| 19 | China Pingmei Shenma Group |

| 20 | Henan Energy and Chemical Industry Group Co., Ltd |

| 21 | Huayang New Material Science And Technology Group Co., Ltd |

| 22 | Lu’An Chemical Group Co., Ltd |

| 23 | Xinjiang Zhongtai (Group) Co., Ltd |

| 24 | China National Chemical Engineering Co., LTD |

| 25 | Dongming Petrochemical |

| 26 | LiHuaYi Group |

| 27 | Wanda Holdings Group Co., Ltd |

| 28 | ENN Natural Gas |

| 29 | Yuntianhua Group Co., Ltd |

| 30 | Wanhua Chemical Group |

| 31 | TongKung Group |

| 32 | China Risun Coal Chemicals Group Limited |

| 33 | ChamBroad Holding Group |

| 34 | Shangdong Haike Group |

| 35 | Guizhou Phosphorus Chemical Group |

| 36 | Panjin North China Liqing Company Limited |

| 37 | Shaanxi Pengfei Group |

| 38 | Highsun Holding Group |

| 39 | Fujian Eversun Holding Group |

| 40 | Fujia Group |

| 41 | Dongyin Qirun Chemical Industry Co., Ltd |

| 42 | Tianjin Bohai Chemical Group(BHCC) |

| 43 | Qicheng Holding Group |

| 44 | Shangdong Wonfull Petrochemical Group |

| 45 | Shangdong Jinling Group |

| 46 | Fuhai Group New Energy Holdings Limited |

| 47 | Huafeng Group |

| 48 | Shandong Jincheng Petrochemical Group Co., Ltd |

| 49 | Shanghai Huayi (Group) |

| 50 | Yichang Xingfa Group Co., Ltd |

| 51 | Shandong Qingyuan Group Company Ltd |

| 52 | Panjin Haoye Chemical Co., Ltd |

| 53 | Shandong Hengyuan Petroleum Chemical Group Limited |

| 54 | Xinjiang Tianye (Group) Co., Ltd |

| 55 | Xinfengming Group Co |

| 56 | Shanxi Lubao Coking Group Co., Ltd |

| 57 | Kingfa Sci & Tec Co |

| 58 | Hebei Xinhai Holding Co., Ltd |

| 59 | Shandong Shouguang Luqing Petrochemical Co., Ltd |

| 60 | Luxi Group Co., Ltd |

| 61 | Juhua Group Corporation |

| 62 | Dawn Group |

| 63 | Zhejiang Longsheng Group Co., Ltd |

| 64 | Hebei Chengxin Co., Ltd |

| 65 | Wantong Haixin Holding Group |

| 66 | Yibin Tianyuan Group Co., Ltd |

| 67 | North Huajin Chemical Industries Group Corporation |

| 68 | Shandong Zhonghai Chemical Group |

| 69 | Shandong Kenli Petrifaction Group Co., Ltd |

| 70 | Zhongce Rubber Group Co., Ltd |

| 71 | Jiangsu Xinhai Petroleum & Chemical Co., Ltd |

| 72 | Shandong Yongxin Energy Group |

| 73 | Zibo Qixiang Tengda Chemical Co., Ltd |

| 74 | New Solar Technology Group Co., Ltd |

| 75 | Befar Group Co |

| 76 | Tangshan Sanyou Group Chemical Fiber Limited Company |

| 77 | Zhejiang Transfar Group |

| 78 | Shengxing Group |

| 79 | Wudi Xinyue Chemical Group |

| 80 | Shandong Tianhong Chemistry Co., Ltd. |

| 81 | COFCO Corporation |

| 82 | Sinoma Science&Technology |

| 83 | Red Sun Group Co.,Ltd |

| 84 | China Kingho Energy Group Limited |

| 85 | Kailuan Energy Chemical Co., Ltd |

| 86 | Wenlan Tianlan New Energy Co., Ltd |

| 87 | Hebei Kaiyue Group |

| 88 | Anhui Huilong Group |

| 89 | Shandong Rongxing Group |

| 90 | Ningxia Baofeng Energy Group |

| 91 | Shandong Alliance Chemical Group Limited Company |

| 92 | Shandong Haili Chemical Industry Co., Ltd |

| 93 | Sailun Group |

| 94 | Shaangu Group |

| 95 | Guanghui Energy Holding Group |

| 96 | Zhuzhou Times New Material Technology Co., Ltd |

| 97 | Inner Mongolia Junzheng Chemical Co., Ltd |

| 98 | Shandong Shangneng Gourp |

| 99 | Shandong Shenchi Group |

| 100 | Lomon Billions (LB) Group |

Billion Dollar Club of Global Chemical Company(China)

On September 13, 2021, Chemical Weekly released its latest “Billion Dollar Club of Global Chemical Company” ranking. The ranking is based on each company’s 2020 chemical sales, and the threshold for this year’s Billion Dollar Club ranking is $2.8 billion, with BASF, Sinopec, and Dow Chemical occupying the top three spots. German chemical giant BASF continues to hold the top spot, having topped the list 10 times in the past 13 years.

The top ten chemical companies are not much different from 2020, among which three Chinese companies entered the top ten of the list, namely Sinopec, Formosa Plastics Group, and China National Chemical Corporation, with Formosa Plastics Group and China National Chemical Corporation ranking No. 4 and No. 7 respectively, both up one position from the 2020 ranking.

In terms of country distribution, chemical companies from the U.S., Japan, China, and Germany predominate, with 28, 16, 13, and 9 companies from the four countries on the list, respectively. Among the 13 Chinese finalists, Hengli Petrochemicals and Rongsheng Petrochemicals rose significantly in ranking, with Hengli Petrochemicals rising from 27th to 14th last year and Rongsheng Petrochemicals rising from 51st to 24th last year.

| 2021 Ranking | 2020 Ranking | Company(Headquarters) | Chemicals Sales in 2020(Billion Dollar) |

| 2 | 2 | Sinopec (China) | 57,042 |

| 4 | 5 | Formosa Plastics Group (Taiwan, China) | 34,715 |

| 7 | 8 | China Chemical (China) | 32,031 |

| 14 | 27 | Hengli Group (China) | 20,979 |

| 24 | 51 | Rongsheng Petrochemical | 14,163 |

| 39 | 42 | Wanhua Chemical (China) | 10,163 |

| 44 | Shanghai Petrochemical(China) | 9,554 | |

| 54 | 35 | Heng Yi Petrochemical(China) | 7,472 |

| 68 | 56 | Tongkun Group(China) | 5,616 |

| 76 | Kingfa Sci & Tec Co | 4,897 | |

| 81 | 68 | North Huajin Chemical Industries Group Corporation | 4,595 |

| 83 | 84 | Xinfengming Group Co | 4,418 |

| 97 | 86 | Shanghai Huayi (China) | 3,056 |

Due to the impact of the new global crown epidemic in 2020, 78 chemical companies on the list saw their revenues decline, while the remaining 22 companies saw their revenues increase year on year, with the average sales of $11.8 billion for the companies on the list.

Sales revenue is mainly concentrated between $10-20 billion, with 42 companies in that revenue range and only 14 companies above $20 billion, with BASF and Sinopec breaking the $50 billion mark, and Dow Chemical, Formosa Plastics Group, ExxonMobil, Hercules, and ChemChina with sales revenue of $30-40 billion.

The following is a rough introduction to the 4 domestic companies Sinopec, Hengli Petrochemical, Rongsheng Petrochemical, and Wanhua Chemical 2021 quarter 1 and 2 results.

Sinopec

Sinopec achieved operating revenue of 1.26 trillion yuan in the first half of the year, up 22% year-on-year, with profit attributable to shareholders of 40 billion yuan and earnings per share of 0.33 yuan. Sinopec’s performance in the first half of this year was the best performance in the same period in the past three years.

Sinopec achieved oil and gas equivalent production of 235.29 million barrels in the first half of the year, up 4.2% year-on-year, and natural gas production of 582.6 billion cubic feet, up 13.7% year-on-year. Upstream segment profitability improved significantly, achieving an operating income of 6.2 billion RMB.

In the refining segment, 126 million tons of crude oil were processed in the first half of the year, up 13.7% year-on-year, and 72.19 million tons of refined oil products were produced, up 7.4% year-on-year. The refining segment’s profit rebounded strongly, achieving an operating income of 39.4 billion RMB.

In the chemical segment, Sinopec achieved ethylene production of 6.46 million tons in the first half of the year, an increase of 11.9% year on year. The total operating volume of chemical products was 40 million tons. The chemical segment maintained a good level of profitability, achieving an operating income of 13 billion RMB.

In addition, in the first half of the year, Sinopec completed four sets of hydrogen purification production units in Yanshan Petrochemical, Guangzhou Petrochemical, Gaoqiao Petrochemical, and Hainan Refinery respectively.

In the first half of 2021, with the nationwide New Crown Pneumonia epidemic under effective control, Sinopec’s sales of refined oil products recovered rapidly, achieving a total distribution volume of 109 million tons of refined oil products. As for the non-oil business, Sinopec achieved a 13.2% year-on-year increase in profit in the first half of the year. In the 2021 China Brand Value Evaluation, the brand value of “EJ” reached 18.4 billion RMB, an increase of 2.3 billion RMB. The profitability of the refined oil sales segment improved significantly, with an operating income of RMB 16.1 billion.

In addition, under the promotion of “one base, two wings, and three new” industry patterns, Sinopec accelerated the construction of “oil, gas, hydrogen, electricity, and service” integrated energy refueling stations, and the first carbon-neutral gas station and photovoltaic building-integrated gas station were completed and put into operation, and 20 hydrogen refueling stations, 570 charging and exchanging stations and distributed power stations were completed in China. The company has completed 20 hydrogen refueling stations, 570 charging and exchange stations, and 205 distributed photovoltaic power generation stations in China.

In terms of capital expenditure, Sinopec spent nearly RMB 58 billion on capital expenditure in the first half of the year. The chemical sector spent 19 billion yuan, mainly on Zhenhai and Hainan ethylene projects, Jiujiang aromatics, Yizheng PTA, and other projects. In this regard, Sinopec said that the company pays more attention to quality and efficiency. In terms of investment, it continues to optimize the investment management system and focus on improving the quality and efficiency of investment.

Hengli Petrochemical

As the earliest and fastest leader in the development of the whole industry chain strategy of polyester new materials, Hengli Petrochemical has been vigorously expanding the upstream and downstream high-end production capacity in recent years to build a world-class integrated platform development of “crude oil – aromatics, olefins – PTA, glycol – polyester – civil yarn, industrial yarn, film, plastic”. model.

Rongsheng Petrochemical

On the evening of August 12, 2021, Rongsheng Petrochemical released its 2021 semi-annual report, during which the listed company achieved operating revenue of 84.416 billion yuan, up 67.88% year-on-year, and a net profit of 6.566 billion yuan, up 104.69% year-on-year, with basic earnings per share of 0.65 yuan.

For the reasons for the change in performance, Rongsheng Petrochemical said that the overall production of refining and chemical projects is steadily climbing, contributing to the incremental performance of the company; the spread of raw material products has expanded, and the profitability space is significantly improved. In addition, since this year, the global economic resonance recovery, downstream demand rebounded significantly, crude oil-PX-PTA-polyester and crude-chemical industry chain boom continued to recover, so the company’s industry chain product costs and product spreads have expanded, and profitability increased significantly.

Wanhua Chemical Company

On July 29, 2021, Wanhua Chemical released its semi-annual report, saying that it achieved operating revenue of 67.657 billion yuan in the first half of the year, up 118.91% year-on-year; operating profit of 16.141 billion yuan, up 382.54% year-on-year; net profit of 13.530 billion yuan, up 377.21% year-on-year.

The company reported that in the first half of the year, the Yantai MDI plant completed 1.1 million tons/year of technical reform and expansion, the company’s MDI production capacity to further enhance, and one million tons of ethylene and other new devices were put into operation, the production and sales of major products increased year-on-year. In addition, with the easing of the global new crown epidemic, the downstream market demand improved; some overseas chemical plants were affected by extreme weather and other factors, resulting in global supply tension and rising prices of chemical raw materials. The company’s main products increased in volume and price compared to the same period last year, and the operating results in the first half of the year increased significantly.

Chemical Plants Near Me

Chemical Plant in China Shanghai

- Shanghai Paristy Daily Chemical Co.,Ltd

- Shanghai Lijin Chemical Industry New Materials Limited Company

- Xiannike Chemical Industry (Shanghai) Limited Company

- Shanghai Luomen Hasi Chemical Industry Limited Company

- Shanghai Qingpu Chemical Industry Limited Company

- Shanghai Fuda Jingxi Chemical Industry Limited Company

- Shanghai Yuan Yongjingxi Chemistry Limited Company

- Shanghai Shenxia Biology Chemical Industry Limited Company

- Shanghai Tanbo Petroleum Chemical Industry Limited Company

- Shanghai China Chemical Group Company

- Shanghai Xilong Chemical Industry Limited Company

- Shanghai Zhonghao Chenguang Chemical Industry New Materials Limited Company

- Shanghai Langyuan Chemical Industry Limited Company

- Shanghai Chemical Industry Light Industry General Company

- Shanghai Xindao Chemical Industry Limited Company

- Shanghai Donntal Chemicals Co.,Ltd

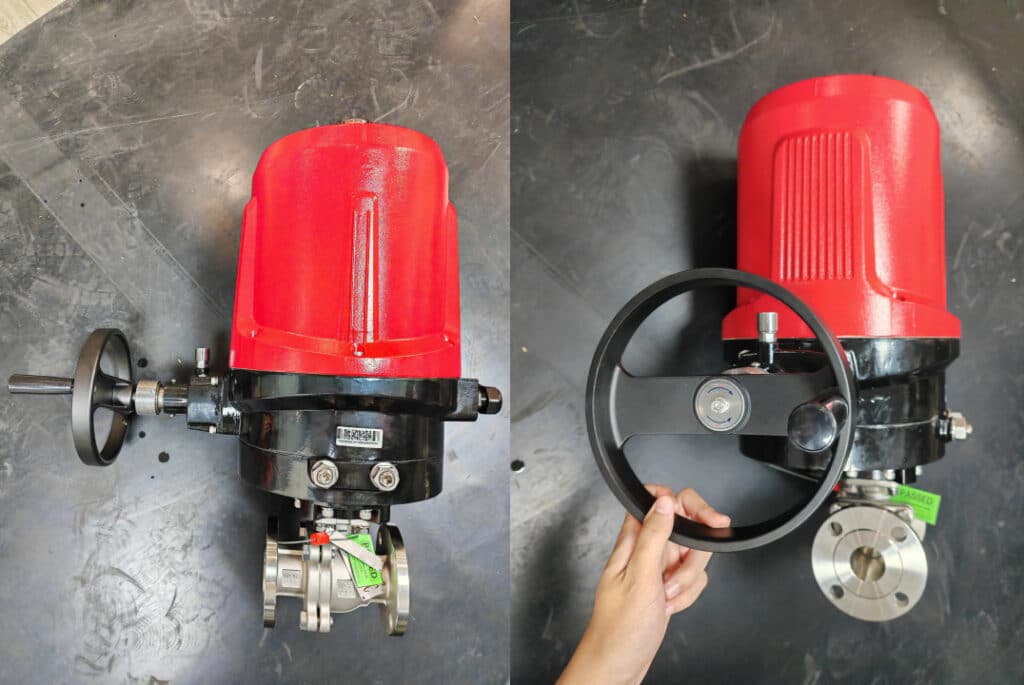

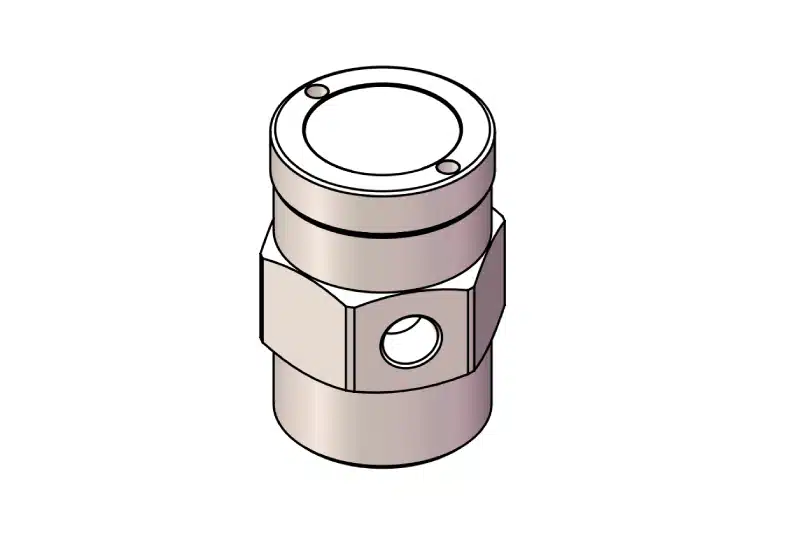

In Conclusion, As a professional valve manufacturer, THINKTANK have been served many famous chemical companies around the world, we have rich project experience and standardized processes of production. So if you have a related project in the chemical industry, we are pleased to provide a free consultation.